Careers

Tax Intern

Internship Period: Commencing from Feb/Mar, with a tenure of 6 months

Jobscope: Assisting seniors in dealing with taxation matters.

Secretarial Intern

Internship Period: 6 months

Job Scope:

- Assisting seniors in dealing with secretarial matters (annual return, preparing CTC documents, directors’ resolution, members’ resolution, etc.).

- Handling basic data entry for accounting works.

Tax Intern

Internship Period: Commencing from Feb/Mar, with a tenure of 6 months

Jobscope: Assisting seniors in dealing with taxation matters.

Secretarial Intern

Internship Period: 6 months

Job Scope:

- Assisting seniors in dealing with secretarial matters (annual return, preparing CTC documents, directors’ resolution, members’ resolution, etc.).

- Handling basic data entry for accounting works.

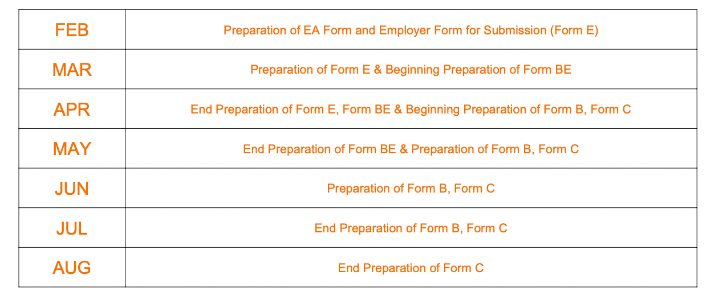

Job Distributions for Tax Intern Roles

Remarks:

Form C – Income Tax Return form for Company Form BE – Income Tax Return form for Individual who only receives employment income Form B – Income Tax Return form for Individual who has businesses (sole proprietor or partnership) Form E – A declaration report submitted by every employer to inform the Inland Revenue Board (IRB) on the number of employees and the list of employees’ income details every year

Form C – Income Tax Return form for Company Form BE – Income Tax Return form for Individual who only receives employment income Form B – Income Tax Return form for Individual who has businesses (sole proprietor or partnership) Form E – A declaration report submitted by every employer to inform the Inland Revenue Board (IRB) on the number of employees and the list of employees’ income details every year

Note:

Interns are provided the flexibility to select between roles, focusing on taxation or secretarial responsibilities. Alternatively, they can opt for both roles, enhancing their learning experience to the fullest extent.

Interns are provided the flexibility to select between roles, focusing on taxation or secretarial responsibilities. Alternatively, they can opt for both roles, enhancing their learning experience to the fullest extent.

WHY CHOOSE US?

- Expose to different roles for adaptation and allow exploration

- Hands-on experience client dealing experience

- Motivating, supportive seniors that willing to teach

- Increase productivity within working hours, only overtime when necessary

- Huge exposure with more than 500 clients in various industries

- Work hard, play hard culture

- Opportunity to transfer as permanent employee

CHAT WITH US

Contact us for information on job vacancies and take advantage of our team’s extensive knowledge and years of practical experience